Required Documents, Fees and Limit

For businesses, GST registration is mandatory. As per the GST rules, businesses with annual turnover above Rs.40Lakhs register as normal taxable entity. Process of registering a business under GST (Goods & Services Tax) is known as GST registration.

It is against the GST rules, if the organization operate business without registering under GST and heavy penalties apply. Continue reading to know more about the process of GST registration and know about the required documents and fee.

- What is GST Registration?

- Eligibility and Threshold Limit for GST Registration

- GST Registration Process

- GST Registration Fees

- Required Documents for GST Registration

- Penalty for not registering under GST

sample image is required

What is GST Registration?

As per the GST rules, businesses with annual turnover above Rs.40Lakhs are mandatory to register under GST. Businesses in hill states and northeastern states have a turnover of 10 lakhs. It takes 6 working days to complete the GST registration process.

Once the GST registration process is completed, the Central Government provides a GSTIN (Goods and Service Tax Identification Number). GSTIN is a 15-digit unique number used to determine whether a company is responsible to pay the GST or not.

Eligibility and Threshold Limit for GST Registration

- A person can register under the Pre-GST law (i.e. Excise, VAT, Service Tax, etc.)

- Businesses having annual turnover above the threshold limit of Rs. 40/- Lakhs and for North-Eastern States, J&K, Himachal Pradesh, and Uttarakhand limit of Rs. 10/-Lakhs

- Casual taxable person / Non-Resident taxable person

- Distributors of input services and agents of suppliers

- Taxpayers using the reverse charge method

- A company that uses an e-commerce aggregator

- Every e-commerce aggregator

- Person who provides the online information and database access or retrieval services to a person in India or a place outside India, other than a registered taxable person.

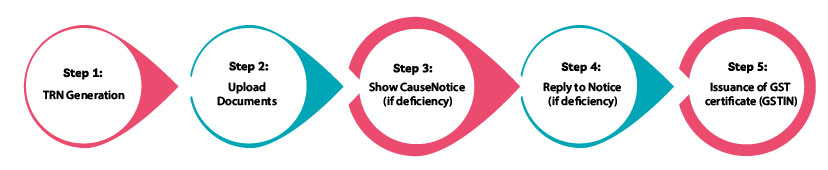

GST Registration Process

The procedure of GST registration is as follows:

1. TRN Generation

2. Upload Documents

3. Show Cause Notice (if deficiency)

4. Reply to Notice (if deficiency)

5. Issuance of GST certificate (GSTIN)

Registration Fee for GST

Using Taxcult to register a business under GST costs only Rs.1599/-.

Required Documents for GST Registration

1. Copy of Pan Card of the Applicant/ Company

2. Copy of Aadhaar Card

3. Incorporation Certificate or Business Registration Proof

4. Address Proof (Rent Agreement/Electricity Bill)

5. Canceled Cheque/Bank Statement

6. Digital Signature

7. Passport Size Photograph

8. Letter of Authorization / Board Resolution for Authorized Signatory

Penalty for not Registering Under GST

If business does not pat a tax or pay a lesser amount than the tax, the penalty charges will be 10% of the due amount (in case of genuine errors). However, Rs. 10,000/- is the minimum penalty.

If business does not register for GST and are deliberately trying to evade tax, the penalty will be 100% of the due tax amount.