Online Procedure and Charges

To authenticate and verify the identity of the person or entity holding this certificate, the certifying authorities will issue a digital signature certificate, which is a secure digital key (USB e-Token). The signatures are generated using public-key encryptions, and they are included in digital format.

A digital signature certificate (DSC) includes the following details: the user’s name, email address, country, pin code, date of certificate issuance, and name of certifying authority.

- What is DSC?

- Advantages of DSC

- The Value of DSC

- DSC Classes

- Documentation needed for the DSC

- Certificate Fees for Digital Signatures

- Frequently Asked Questions

What is Digital Signature Certificate?

An encrypted electronic signature that serves as a representation of a person’s identity is called a Digital Signature Certificate (DSC). A certifying agency designated by the Controller of Certification Agencies (CCA) issues the DSC to persons. People must receive a Class 3 DSC to file numerous government forms online, including income tax returns, corporate annual returns, GST returns, and other statutory forms. Similarly, companies must provide the DSCs of the relevant individuals when registering on the MCA portal, filing returns, or attaching needed documents.

Advantages of Registering a Private Limited Company

1. Authentication:

When conducting business online, DSC assists in verifying the holder’s personal information data.

2. Reduces Cost and Time:

The holder of a Digital Signature Certificate doesn’t need to be present in person to conduct or approve business. By employing DSC, the holder can swiftly sign hard copy papers online rather than having to physically sign them and scan them to send via email.

3. Authenticity of Documents:

Documents that have been digitally signed offer the recipient assurance about the signer’s legitimacy and inspire confidence. They don’t have to worry about the documents being falsified because they can move forward and take action based on them.

4. Data Integrity:

Digitally signed documents are unchangeable once signed, ensuring the security and safety of the data. DSC is requested by government agencies to verify commercial transactions.

Significance of Digital Signature

When is Digital Signature required?

- Company Incorporation – Incorporating a Public Limited Company, Private Limited Company, Limited Liability Partnership, or One person company requires a Digital Signature Certificate.

- Director Number – You utilize the Digital Signature Certificate (DSC) while requesting a DIN number.

- MCA Compliances – The Ministry of Corporate Affairs has mandated that businesses exclusively use digital signatures when filing any reports, petitions, or forms. Verifying returns with DSC is required if a business’s annual turnover is above ₹60 Lakhs.

- Income Tax Filing – Those who must have their accounts audited, both individuals and companies, must electronically file their income tax return with a digital signature.

- GST filing and registration – For both GST registration and verification, business entities (apart from sole proprietorships) must possess a digital signature certificate.

- Code for Import Export – Having DSC is required when requesting an import and export code.

- Copyright – To apply intellectual property rights, such as a patent, trademark, or other property, you must have a digital signature certificate.

- Employee Provident Fund – The Class 3 Digital Signature Certificate can be used by registered employers in India to electronically submit their Employee Provident Fund Transfer Claim form.

Who requires a Digital Signature Certificate?

The MCA has required digital signatures from the following people:

- Directors.

- Examiners.

- Secretaries of Companies.

- Bank officials.

- CEOs and CFOs.

- Additional Appropriate Signatories.

Digital Signature Certificate Classes.

The certifying authorities provide three different kinds of certificates for digital signatures:

Class 1 DSC

Individual subscribers receive Class 1 DSCs, which are used to verify that the user’s name and email address from the clearly defined subject is stored in the certifying authority’s database.

Class 2 DSC

The director and signatory authority of the firms receive a Class 2 DSC for electronic filing with the Registrar of Firms (ROC). When submitting returns with the ROC, people who need to manually sign papers must use a Class 2 digital signature. Nevertheless, the Controller of Certifying Authority has directed that Class 2 DSC be discontinued as of January 1, 2021. Class 2 DSC will not be granted; instead, Class 3 DSC will be.

Class 3 DSC

Directors and other authorized signatories of businesses, professionals, etc. are granted a Class 3 Digital Signature Certificate to digitally sign documents. Additionally, vendors with a Class 3 DSC are required to participate in the online bids.

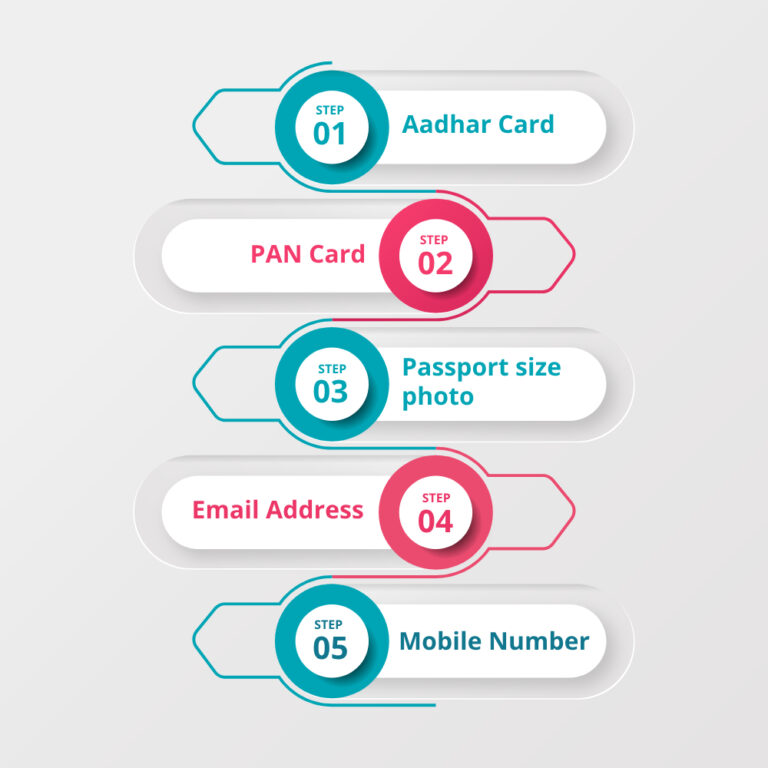

Required Documents for Online Application for Digital Signature Certificate

You will need to submit an application and produce specific paperwork to be granted a Digital Signature Certificate (DSC). Usually, the following paperwork is needed:

- Aadhar Card: As identification and proof of address, a copy of your Aadhar Card is required. It confirms your residential address and certifies your identification.

- PAN Card: To verify your identity, a copy of your Permanent Account Number (PAN) card is needed. It guarantees that your tax-related data is linked to the DSC application.

- Passport Size Photo: The passport-sized photo that you submit must be recent and will be included in your DSC application form. The image must be clear and adhere to the guidelines.

- Email Address: A working email address is required. Your DSC will be linked to this email address, which will be used for correspondence and digital certificate delivery.

- Mobile Number: A working mobile number must be provided by you. This number will be used to confirm identity and to get OTPs (one-time passwords) and other crucial alerts.

Required Documents for DSC Issuance (With GST Verification)

Documents for Proprietorship Firm

- The applicant’s Aadhar card or Pan card number is listed in order.

- No more than three months’ worth of bank statements or GSTR 3b filing copies.

Documents for Partnership Firm

- The applicant’s Aadhar card or Pan card number is listed in order.

- Authorized signatory letter.

- Partnership agreement.

- ID proof signed by the authorizing person.

- Bank statement or GSTR 3b filing copy that is no more than three months old

Corporate Entities

- The applicant’s Aadhar card or Pan card number is listed in order.

- Authorized board resolution or signature letter.

- List of McA Signatories.

- ID proof signed by the authorizing person.

- Bank statement/ GSTR 3b filing copy not older then 3 months.

- The applicant’s Aadhar card or Pan card number is listed in order.

- A signed authorization letter.

- Partnership agreement.

- ID proof signed by the authorizing person.

- Bank statement/ GSTR 3b filing copy not older then 3 months.

Documents for AOP

- The applicant’s Aadhar card or Pan card number is listed in order.

- Authorized signatory letter

- Signatory list.

- Authorizing Person Sign id proof.

- Bank statement/ GSTR 3b filing copy not older then 3 months

Documents for NGO/Trust

- The applicant’s Aadhar card or Pan card number is listed in order.

- A signed authorization letter.

- Partnership agreement.

- ID proof signed by the authorizing person.

- Bank statement/ GSTR 3b filing copy not older then 3 months.

Required Documents for DSC Issuance (Without GST Verification)

Documents for Proprietorship Firm

- The applicant’s Aadhar card or Pan card number is listed in order.

- Organization bank statement

- Organization registration copy

Partnership Firm Documents

- Applicant Pancard/aadharcard which no is mentioned in order.

- Authorized signatory letter.

- Organization bank statement.

- Copy of organization registration.

- Organization Pan card

- Deed of partnership.

Corporate Entities

- The applicant’s Aadhar card or Pan card number is listed in order.

- Board decision or a signed letter of authorization

- Organization bank statement.

- Certificate of incorporation.

- Organization Pan card.

- MCA list of signatories.

- Authorizing person sign id proof.

LLP

- Applicant Pan card/aadhar card which no. is mentioned in order.

- Board decision or a signed letter of authorization

- Bank statement of the organization.

- Certificate of incorporation.

- Organization Pan card

- MCA list of signatories

- The signatory to the proof of identity.

Documents for AOP

- Applicant Pan card/aadhar card which no. is mentioned in order.

- Board decision or a signed letter of authorization

- Bank statement of the organization.

- Certificate of incorporation.

- Organization Pan card

- MCA list of signatories

- The signatory to the proof of identity.

Documents for NGO/Trust

- Applicant Pan card/aadhar card which no. is mentioned in order.

- Board decision or a signed letter of authorization

- Bank statement of the organization.

- Certificate of incorporation.

- Organization Pan card

- MCA list of signatories

- The signatory to the proof of identity.

The price and duration involved in issuing a DSC

Getting a DSC for an individual costs just Rs. 1,799, whereas getting a DSC for a business with an authorized signature costs Rs. 2,500. Approximately one to two days would pass before the Digital Signature Certificate is issued.

Frequently Asked Questions (FAQs)

It is an electronic version of a physical signature.

Any individual (including foreign nationals and Indian citizens) and any kind of business entity (trusts, partnerships, limited liability companies, and others) can obtain a digital signature.

One can acquire a digital signature in one to three working days after submitting the application and the necessary documents.

No, in order to issue a digital signature, no physical verification is necessary.

An application for a digital signature must be submitted, together with a self-attested copy of the applicant’s proof of identity and address, a photo of the applicant, and other supporting documentation.

Support

Speak Directly to our Expert Today