Accounting and Auditing

Regarding an organization’s financial records and operations, accounting and auditing are two crucial procedures.

In any business’s financial operations and record-keeping procedure, accounting and auditing are essential. Their focuses and functions, though, diverge. Auditing is more of a specialized service than accounting, which is a much broader topic that covers everything from the organization’s financial flow to the management of the business.

Within the field of accounting is auditing. This involves an impartial analysis of accounting and financial records. This is done to ascertain whether the business venture or the organization has complied with legal requirements and widely accepted accounting standards in its operations.

What are Accounting and Auditing?

Accounting:

One of the most important aspects of a business is accounting. The process of recording, categorizing, summarizing, analyzing, and presenting an organization’s financial transactions, records, profitability, statements, and financial condition is known as accounting. It is the procedure for documenting a company’s financial transactions.

An organization’s staff often handles its accounting. A concise synopsis of the financial activities throughout an accounting period is provided by the financial statements used in accounting. There are several fields of accounting, including cost accounting, financial accounting, management accounting, and so forth. The management uses the accounting reports to guide its company decisions.

Auditing:

Examining an organization’s financial accounts or records is referred to as auditing. Following the completion of the financial accounts and statements, audits are conducted. It entails doing the required financial statement examination and audit.

An impartial and fair assessment of whether the financial statements and records accurately depict the organization’s genuine financial situation is provided by auditing. On behalf of regulators or shareholders, the auditors, who are typically external individuals or businesses, conduct the auditing process by the appropriate legal provisions.

There are two primary types of auditing: internal and external audits. An internal audit is carried out by one of the business’s employees. An external auditor chosen by the shareholders oversees the external audit.

Similarities Between Accounting and Auditing

The majority of accounting’s and auditing’s fundamental procedures are comparable. Accounting and auditing require a solid understanding of accounting fundamentals and principles. Most often, someone with an accounting degree handles them. To create financial reports and statements, they employ fundamental computation, bookkeeping, and analysis methods and procedures.

Procedures for tasks related to accounting and auditing, including tax compliance, are typically comparable. They may also use the same accrual or cash-based bookkeeping techniques. They work hard to guarantee that the financial statements and records are accurate and fairly represent the state of an organization’s finances.

Why Are Accounting and Auditing Necessary?

Regardless of the size of the organization, accounting aids in monitoring all financial operations. It accurately documents all of the financial activity that occurs, which is an essential piece of data for your company’s administration.

Business owners can assess their company’s performance and conduct peer-to-peer comparisons when their books are kept current in compliance with generally accepted accounting principles. Establishing and preserving credibility with vendors and rivals is contingent upon this.

Accounting assists in pinpointing areas of underperformance and those in need of remediation. The data gathered from accounting also helps with the business’s long-term project planning. The company’s financial standing influences several decisions, including how much credit is available and at what interest rates. Investors will have a comprehensive understanding of the risks and potential rewards that the business may present. Maintaining the accounts will benefit you later on when it comes to filing your returns, paying taxes, and claiming deductions.

Auditing is crucial since it provides an objective picture of the company. Through the process of auditing, business owners can often find faults in their systems and implement corrective measures. It also guarantees transparency.

External auditing ensures a positive public image, enhances relationships with suppliers and clients, and helps the business gain credibility. Future business sales will be simpler because the auditing procedure will already have been completed. It may also raise the company’s credit rating. so grabbing the interest of the bank and investors.

What Role Does Auditing Play in Accounting?

Within its broad framework, the topic of accounting encompasses numerous areas of specialization. Among these specialties is auditing. Accounting is the study and documentation of financial transactions; auditing is the process of confirming that the accounts are accurate. The integrity of a company’s entire accounting system is ascertained through auditing in a variety of methods. Even if your business is public or non-profit, annual financial statement audits are nonetheless crucial. This will strengthen the validity of your accuracy. Having an auditing system in place is a good idea even if it is not required.

When there are inaccuracies in your accounting, auditing becomes even more crucial. An auditor might play a big role in revealing data if your bookkeeping has not been accurate or organized. It is advisable to hire a forensic auditor if the information revealed suggests that fraud or other wrongdoings may have occurred. Even in the subject of audits, there is a further subfield that handles situations that almost seem like criminal activity.

Benefits of Accounting and Auditing

It doesn’t have to be a bad or stressful experience whether your company needs an audit because of industry requirements, or because prospective investors or other stakeholders demand it.

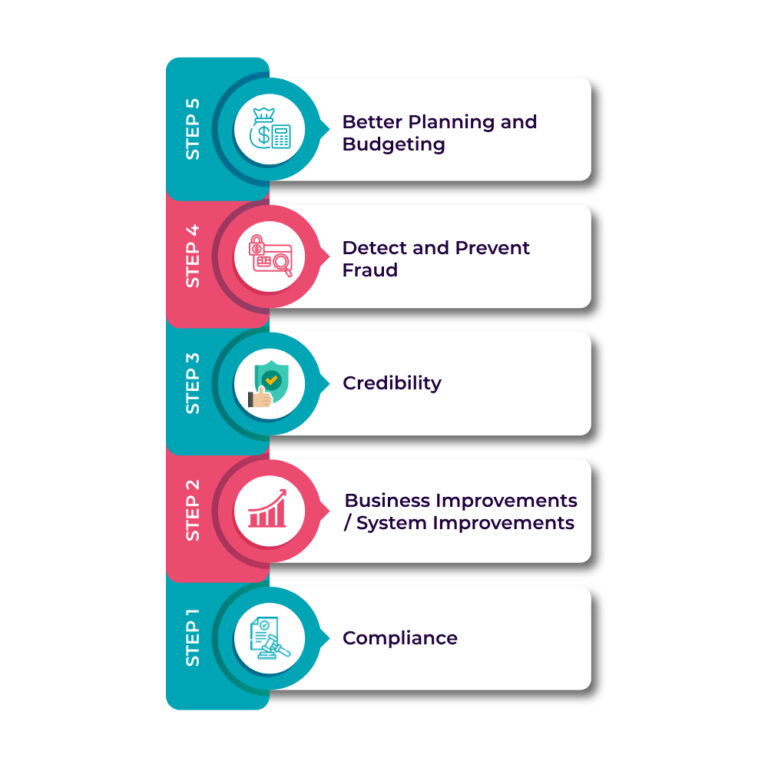

1. Compliance

One of the primary goals of an audit is to comply with industry regulations and regulatory obligations. Business owners and shareholders can rest easy knowing that their company complies fully with all current legal requirements thanks to an audit. The potential consequences of non-compliance are severe fines, lost business, and a damaged reputation, which much outweighs the expense and any small, transient discomfort an audit may create.

2. Business Improvements / System Improvements

A comprehensive, in-depth audit examines your company’s internal controls and systems objectively. This implies that it’s a perfect chance for auditing professionals to recommend enhancements that can boost the productivity of your company. The audit process can be used to find opportunities to enhance internal controls, business systems, accounting procedures, efficiency, governance, and culture.

3. Credibility

The financial statements’ accuracy and fairness as a reflection of the entity’s current position are independently verified by an audit. This gives your organization’s stakeholders, investors, lenders, and even prospective customers vital credibility and confidence. It’s proof positive that everything is as it seems on the financial front.

4. Detect and Prevent Fraud

Up to 30% of enterprises in New Zealand are thought to be vulnerable to corruption, fraud, and mistakes. Workplace fraud can go unnoticed for years at a time and be so serious that some companies never fully recover financially or rebuild their image. Finding fraud and potential for fraud can be accomplished with the help of an audit. Skilled auditors are adept at identifying gaps in an organization’s systems and controls and making recommendations for how to make them stronger to stop fraud from happening.

5. Better Planning and Budgeting

An audit examines an organization’s financial transactions to verify the correctness of its financial statements. This meticulous procedure may lead to certain categories of earnings, expenses, assets, and liabilities being closely examined. Business owners can then use this critical analysis and the auditor’s financial knowledge to make better financial plans, budgets, and decisions in the future.

Frequently Asked Questions(FAQs)

The capital markets benefit from the trust and certainty that auditors provide to financial reporting. To guarantee that data, including the financial statements, offer a true and fair picture of a company’s financial performance and situation, auditors conduct independent assessments.

Accountants make up auditors! The majority of auditors major in accounting and choose to become corporate, tax, internal, or public company auditors, among other types of accountants. A career as a public business auditor is an option.

Auditors for public companies certainly have a busy season, but they can prepare ahead because they are aware of it well in advance. Furthermore, a lot of companies provide benefits to help with employee wellness, which are frequently excellent ways to offset the effects of the hectic season.

The following are some terminology you should be familiar with in accounting:

Cost of goods sold (COGS): This is the amount of money used to produce a product. It has a significant impact on how profitable your company is.

Inventory consists of things in storage for raw materials, products in production, and completed commodities that are offered for sale.

Liabilities: The money you owe is referred to as your liabilities. Liabilities can be classified as either long-term or short-term; short-term liabilities are those that are due within a year, while long-term liabilities are those that are not.

Financial accounting: In this kind of accounting, accountants compile reports that are based on the company’s commercial dealings over an extended period. The public and private sectors both use financial accounting.

Administrative accounting- Accounting that is focused on the administrative facets of the business is known as administrative accounting. It is employed in the forecasting and planning of the resources and actions that can be utilized to accomplish the goals of the business.

Tax accounting- Tax accounting is the process of registering, creating reports, paying taxes, and submitting tax returns to the public treasury.

Management accounting- The practice of creating reports on business operations so that the organization can act swiftly on business matters is known as management accounting. Accounting for management aids in the company’s accomplishment of its objectives.

There are a few strategies that might support you in keeping your accounting accurate. Let’s examine this:

1. To keep accounting accurate, you must identify income sources.

2. You must maintain a record of all invoices and receipts.

3. Filing tax returns is a smart strategy to stay out of trouble.

4. Maintaining accounting accuracy can also be achieved through the preparation of financial statements.

5. You want to monitor the deductible expenses at all times.