Import Export Code Registration

Every import/export transaction requires the use of an import export code, which is a ten-digit unique code provided to a person or business. Importing and exporting goods and services is the first step in growing a company overseas. Trading benefits the nation as a whole in addition to business professionals on an individual basis. In an effort to cut down on transaction costs and time, the government has given trade facilitation top priority.

For the benefit of import and export trade, the many sections of the foreign trade Policy and government initiatives toward trade facilitation have been combined. Growth is the most important aspect of a successful business. Global business expansion may be the first step in achieving this. The yearly renewal of import export codes is now required for holders of IEC licenses. Exporters can apply for port registration on the icegate portal with the aid of AD Code registration once an import export code has been granted.

- What is Import Export Code?

- Advantages of Import Export License

- Required documents for IEC registration

- Registration Fees for Import Export Codes

- How to Apply for an Export and Import License

- Is an Import Export Code Enough to Export Items from India?

- Validity and Renewal of IEC

- IEC Register Online with Taxcult

- Frequently Asked Questions

IEC Certificate sample image is required

What is Import Export Code?

Every import/export transaction requires the use of an import export code, which is a ten-digit unique code provided to a person or business. The authority to issue import export codes rests with the DGFT. Director General of Foreign Trade is referred to as DGFT. Although import export code is the more popular term, Importer Exporter Code is the whole form of IEC.

The Import Export Code does not require relicensing like other government licenses do. However, it is necessary to update the IEC license status on the DGFT portal once a year.

Advantages of Import Export License

Because of discussion about business cannot be concluded without addressing profit and loss. Since our goal is to help your company legally, we will be carrying forward the profit share. In an effort to reduce transaction costs and time and boost the competitiveness of Indian exports, the government has prioritized trade facilitation. The numerous provisions of the Foreign Trade Policy and the actions made by the government to facilitate trade are combined for the advantage of import and export commerce.

Are you interested in how IEC could benefit your company? Let’s see how IEC might benefit importers and exporters alike:

- International Trade: Import Export Code gives you the ability to grow your company internationally. The importer exporter code is the most essential and important element you will require when trading internationally. The IEC makes it easier for you to grow and expand internationally.

- Legalize International Business: The code gives you permission to import the essentials of your company into your own country and export your goods and services to any other country. It facilitates easy and legal cross-border trade.

- Online Service: Now it is possible to obtain an IEC while comfortably seated at home. You could receive it at home if you provide complete and exact documents. The need of reaching the government office won’t get in the way.

- Subsidies for import/export: Benefits from the government include import excise exemptions and export subsidies. Tax savings may be provided if the import is finished within the allotted time. Regarding exports, the government provides a subsidy on all export-related taxes. Only those who are enrolled with the IEC are eligible for these benefits.

- Required at Customs: The Bill of Lading must specify the importer’s IEC Code, which must be reported to Customs. The IEC Code of the Indian consignee must be included on all bills of lading for goods that is being transshipped through or heading towards Indian ports.

- Facilitates Electronic Fund Transfer (EFT): Exporters can now pay their license fee online with EFT (Electronic Fund Transfer), a new service that removes the need for them to physically visit a bank. The purpose of this technique is to improve the convenience of electronic payments. Applications submitted only online will be accepted.

Required Documents to Acquire an IEC License

Let’s discuss the documents required to obtain an online import-export code license in India before moving on to the registration process. Any of the following business structures may be used to obtain an IEC: “Proprietorship, Partnership, LLP, Pvt & Public Limited Company, Trust, HUF and Society.”

The following documents would be required:

- PAN of the business entity

- Registration/Certification Number

- Details of the entity’s bank account with Cancelled Cheque

- Identity proof (Aadhaar Card, Voter Id Card, Passport)

- Passport size photograph

Registration Fees for Import Export Code

The government fees are for the registration of an import export code (IEC License). For the registration of an IEC code, professional fees are ₹999. So, the total cost to obtain an IEC certificate will be ₹1499(₹500 + ₹999). The registration of an IEC code involves no cost extra.

| IEC Registration Fees | |

|---|---|

| Aayaat Niryaat Form no. 2A | NIL |

| Filing at DGFT | NIL |

| Govt. Fees | Rs. 500 |

| Taxcult Fees | Rs. 999 |

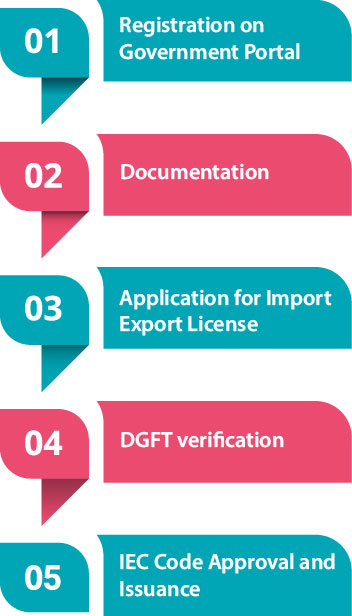

Steps for obtaining Import Export License

An import export license is available both offline and online. To apply online, one needs to understand how to get an IEC code. There are five main steps that comprise the entire procedure. Let’s learn more about them in detail:

Step 1. Registration on Government Portal

Registration is the initial step in the online application process for an import export license. Online registration is available via the DGFT government portal.

Step 2. Documentation

The next step after registration is the applying phase. Every document is organized and prepared for submission. As we previously mentioned, you might already be aware of all the documents required to submit an online IEC application.

Step 3. Application for Import Export License

The following step includes the uploading of documents and form filling. It is important to fill out the “ANF2A” (Aayat Niryat Form 2A) and attach all required documentation.

Step 4: DGFT verification

After submission your application form is sent to the DGFT for document verification. The documents you provided could determine whether your application is approved or rejected. Therefore, you must be careful while uploading the documents.

Step 5: IEC Code Approval and Issuance

This is the final step of getting your Import Export Code. You will receive your Import Export Code once DGFT approves your IEC application. If your online application is accepted and approved by the appropriate authority, you will receive an e-IEC. Email notification that your e-IEC is accessible on the DGFT website will be sent to you.

Validity and Renewal of IEC

The Import Export Code was not previously required to be renewed on a regular basis, in contrast to other government licenses. On February 12, 2021, changes were made to the provisions related to the Import Export Code under Chapters 1 and 2 of the Foreign Trade Policy. As a result, the Import Export Code must now be renewed yearly. All IEC or e-IEC holders on the DGFT portal are now required to update their IEC code details yearly as a result of this amendment. It is necessary to confirm the information online even if there are no updates in IEC.

Is an Import Export Code Enough to Export Items from India?

To operate an export company in India, you require more than just an import export code. Having an IE Code is not enough, even if it is required to start export activities. To proceed, other mandatory documents and registrations are required.

The rules and regulations differ based on the type of goods you export. Every commodity has an export promotion council, and you have to register every commodity you want to export.

For example, in order to export spices from India, you must first register with the Spice Board. Similarly, exporting tea or coffee requires registration with the Tea Board and the Coffee Board, respectively.

Other Export Promotion Councils include TEXPROCIL, MPEDA, Rubber Board, APEDA, CAPEXIL, and others. Furthermore, foreign transactions and port customs clearance require AD code registration.

Register for an Import Export code Online with Taxcult

It may be a bit challenging to understand the procedure and to provide the required documentation. There is a significant risk of application rejection at every stage of the document submission process. Depending on their requirements, one must upload a digital signature certificate in one of several formats. It is advisable to seek expert assistance to streamline the IEC application procedure.

Step1:

Get in touch via call or contact form

Step2:

Give the required documents

Step3:

In 3-4 days, Get your IEC register

Frequently Asked Questions(FAQs)

There are a few steps you must take:

- Go to Official site

- Apply for new IEC

- Fill all the details

- Receive temporary password

- Successfully registered

- Submit documents

- Get IEC

A company or individual must have an Import Export Code, or IEC, which is a 10-digit code, in order to import or export products or services. This code is issued by DGFT (Director General of Foreign trade), Ministry of Commerce and Industries, Government of India. The IEC code id valid for the lifetime, , thus it doesn’t need to be renewed. After the necessary modifications are made and the documents are submitted, this code is generated within 5 to 15 working days.

We process the IEC code for you or your company in 4-5 working days.

Electronic Fund Transfer (EFT): This new facility enables exporters to pay their license fee online instead of going to a bank by sending in their money via the Internet. The purpose of this technique is to improve the convenience of electronic payments. Applications submitted only online will be accepted. An exporter who holds a valid Importer Exporter Code (IEC) is required to have an Internet Banking account with one of the banks, along with their ID and password.

Yes, you can. You must notify the issuing authorities about your decision. And after electronically sending your IEC number to DGFT so that it can be forwarded to Customs and Regional Authorities, they will immediately cancel it.

Other Import/Export Services

| Import Export Code Renewal | ICPTA Certificate Registration | IJCEPA Certificate Registration | UAE CEPA Certificate Registration |

| IIP UN Mark Certificate | Apeda Registration | AD code Registration | Tea Board Registration |

| SEPC Registration | FIEO Registration | Coconut Board Registration | CLE Council of Leather Export |

| Coffee Board Registration | Merchandise exports from India | Spice Board Registration | MSDS(Material Safety Data Registration) |

| SAFTA License | SAPTA License | APTA Certificate Registration | Capexil Certificate |

| ISCECA Certificate | MSDS (SDS) Certificate For importers | EPCH Membership Registration | MPEDA Registration Online |

| Rubber Board Registration | Texprocil Registration | Chemexcil Registration | Carpet Export Promotion Council |

| Cashew Export Promotion Council | Plastic Export Promotion Council | Handloom Export Promotion Council | Silk Export Promotion Council |

Import Export Code Registration in other States

| Andhra Pradesh | Assam | Arunachal Pradesh | Andaman and Nicobar Islands |

| Bangalore | Chhattisgarh | Delhi | Goa |

| Gujarat | Haryana | Himachal Pradesh | Jammu Kashmir |

| Jharkhand | Karnataka | Kerala | Madhya Pradesh |

| Maharashtra | Orissa | Punjab | Rajasthan |

| Tamil Nadu | Telangana | Uttar Pradesh | Uttarakhand |

| West Bengal |

Import Export Code Registration in Other Cities

| Pinjore | Varanasi | Belagavi | Mysore |

| Guwahati | Pune | Hyderabad | Hosdurg |

| Visakhapatnam | Vadodara | Kolkata | Surat |

| Kothrud | Hisar | Dhanbad | Manglore |

| Tumkur | Ranchi | Bhadravati | Rajkot |

| Chennai | Korba | Mumbai | Sonipat |

| Faridabad | Jamshedpur | Bokaro | Palakkad |

| Kannur | Raigarh | Indore | Ahmedabad |

| Gurgaon | Pithampur | Ujjain | Jaipur |

| Panna | Dewas | Calicut | Ankleshwar |

| Chandigarh | Digboi | Thrissur | Bhilai |

| Thiruvananthapuram | New Delhi | Margao | Guntur |

| Panipat | Khandwa | Vijayawada | Dibrugarh |

| Gandhinagar |