Fees and Documents Required.

In India, incorporating a firm as a Private Limited firm is the most straightforward and reliable option. Because of its advantageous characteristics, such as restricted liability and separate legal entity status for its directors and shareholders, the majority of people opt for this type of business registration. about 90% of Indian corporations that are registered. It is the most often used method of registering a corporation since it gives the enterprise credibility and reputation in the marketplace. Learn about the procedures, costs, and processes for registering a Pvt. Ltd.

- What is a Private Limited Company?

- Advantages of a Limited Company.

- Requirements minimal for inclusion

- Registration Procedure for Private Limited Companies

- Documents needed to register a private limited company

- Documents you’ll receive after being incorporated

- Registration expenses for Private Limited Companies

- The entire amount of time needed to register

- Frequently Requested Information

Pvt. Ltd. Company - Incorporation Certificate [Sample]

Document Required.

A Private Limited Company: What Is It?

One kind of corporate entity that a small group of people owns both individually and collectively is a private limited company. The Ministry of Corporate Affairs is where it is incorporated. Shares in this kind of company entity can only be sold privately, and its shareholders have limited responsibility. It might have as little as two members or as many as 200. It is believed that the owners of a firm are its shareholders, that its directors are its key managerial personnel (KMPs), and that its partners are both the owners and the KMPs.

Establishing a Private Limited Company is the best option because it offers advantages in terms of taxes, credibility, business growth, and expedited approval of business loans. It encourages users to combine their assets and develop capital in a simple method.

Advantages of registering a private limited company.

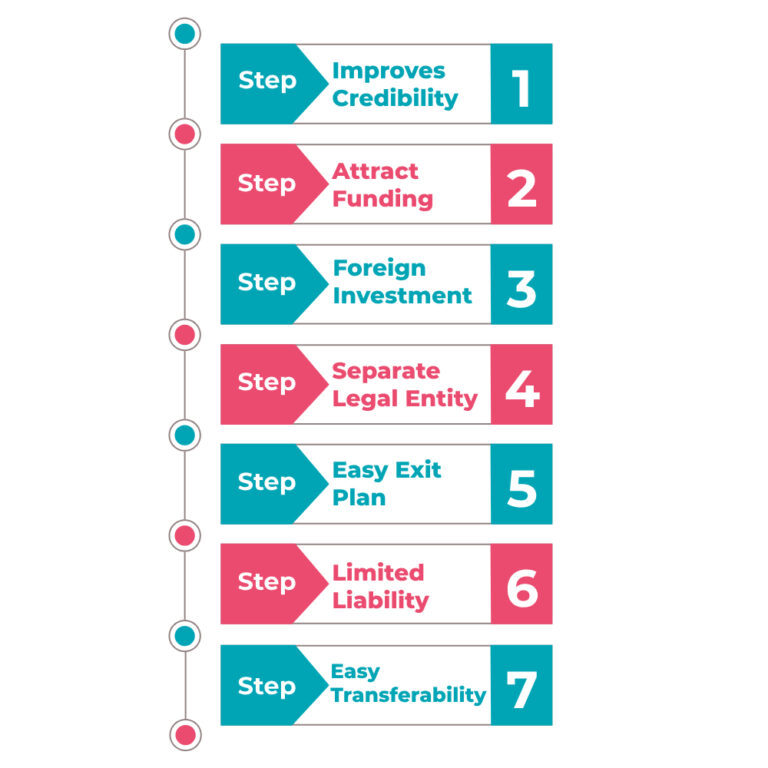

Let’s examine the advantages of registering a private limited company in India in more detail:

Step 7:- Easy Transferability

By transferring shares, it is simple to change a company’s ownership.

Step 1:- Improves Credibility.

Private Company’s registration as a corporate organization enhances its credibility.

Step 2:- Attract Funding.

Syndicate debt as well as equity funds together to achieve the best possible capital structure.

Step 3:- Foreign Investment.

Businesses may use the automatic method to draw in foreign direct investment (FDI).

Step 4:- Separate Legal Entity.

The owner of the company can preserve their assets apart from the business by forming a Private Limited Company, which is a separate legal entity. This implies that there is no personal culpability for the firm owners.

Step 5:- Easy Exit Plan.

It has an exit strategy that involves selling off or diluting the company’s shares.

Step 6:- Limited Liability.

With limited liability protection, it aids in preserving the owners’ assets.

Minimum standards for registering a Pvt. Ltd. company.

To incorporate a company online, certain minimum conditions must be fulfilled by the Companies Act of 2013.

Minimum 2 directors

Distinctive company name

India should be the home country of at least one director.

The address of the registered office

Procedure for Delhi Pvt. Ltd. (Private Limited) Company Registration

If you find the process difficult and time-consuming, simply get in touch with our staff at Taxcult to handle the full documentation and registration of your Delhi private limited company. The steps involved in registering a Private Limited (Pvt Ltd) firm in Delhi are shown below:

Step1:- Request a Certificate of Digital Signature.

Obtaining a Digital Signature Certificate from the government is crucial for the online company registration process, which is part of the company incorporation process. A Digital Signature Certificate, also known as a DSC, serves as evidence of the director’s identification and is necessary for them to sign digital documents throughout the online company incorporation registration process.

Step2:- A unique business name should be reserved.

The next stage after receiving DSC is to reserve a unique name for your company and ensure that, in accordance with the information provided in Rule 8 of the company incorporation rules, the business name cannot be the same as or identical to any existing registered firm.

Step3:- Completed SPICe Form (INC-32)

Following name approval, the SPICe+ form on the MCA portal must be filled out with the company registration details. This comprehensive form is used to create a private limited business in Delhi online. It is necessary that you complete every field listed below.

- Complete the company’s details.

- Information about its subscribers and members.

- Request a Director Identity Number (DIN).

- File TAN and PAN applications

- Announcement from Subscribers and Directors

- Professional Certification & Declaration

Step 4: MoA and AoA filing

Forms INC-33 and INC-34 must be filled out when submitting an online application for Delhi company registration. The definitions of MoA and AoA of the Companies Act, 2013 are found in section 2(56), which describes the company’s aims and purposes, and section 2(5), which describes the management structure and internal operations of the business.

Step 5: Certificate of Incorporation, PAN, and TAN Issuance

The Department will issue documents like PAN, TAN, Certificate of Incorporation, etc. after receiving approval from the Ministry of Corporate Affairs for the documents mentioned earlier.

Register your Private Limited Company Online with Taxcult

Getting your business registered as a Private Limited Company is a difficult process that requires several compliances. You can streamline the entire registration procedure with the help of our professionals at Taxcult. Enroll your business online in three simple steps:

Reach out via phone or using the contact form.

Give the required paperwork.

Register your incorporation within 10 to 15 working days.

Documents Required for registration of Private Limited Company

You must present appropriate identification and evidence of address to register a private limited company in India. Directors and shareholders of the company must submit these documents through the Ministry of Corporate Affairs (MCA) portal.

Proof of Address and Identity for Directors and Shareholders.

- The directors’ passport-sized photos

- Aadhar Card copy

- A copy of a voter ID or driver’s license

- A duplicate PAN card

- A copy of a utility bill or bank statement that is no more than two months old

- A copy of your passport, if you’re an NRI or foreign national.

Proof of Address for Registered Office

- A copy of the most recent two months’ worth of utility bills, including electricity ones.

- The lease, if it’s rented

- The property owner’s No Objection Certificate (NOC).

Note: Owning a commercial business location is not required to incorporate. To register a firm, one can provide documentation of their residential address.

Documents you'll receive after Delhi online business registration

Document Required.

Document Required.

Document Required.

Document Required.

Document Required

Document Required.

Document Required.

Document Required.

Private Limited Company Registration Fees

Including government and professional expenses, the overall cost of registering a Private Limited Company in India is ₹7,499, and it takes approximately 7 to 10 working days.

| Steps | Cost(Rs.) |

|---|---|

| Certificate of Digital Signature | ₹2,000 |

| Government Charge | ₹1,500 |

| Expert Charge | ₹3,999 |

| Total Charge | ₹7,499 |

Examine Our Packages for Company Incorporation

Registration you should get after Company Incorporation

GST Registration

Shop & Establishment License

Trademark Registration

Start-up India Registration

How long does it take to register a company?

Subject to MCA document verification, the registration process for a private limited company in India typically takes seven to ten working days.

Frequently Asked Questions (FAQs).

If you have all the paperwork together and meet all the conditions listed in the Companies Act of 2013, you can register a private limited company with ease.

In India, you must present proof of identification and address for each member as well as proof of the registered office’s address in order to register a private limited company. Note: You can incorporate using your own home address instead of a commercial location for registration.

No, private limited corporations are exempt from the GST requirement.

There is no minimum capital requirement for private limited company registration. One can start a company with a share capital of as low as ₹10.

Both Pvt Ltd Company and LLP have advantages and disadvantages. It is entirely dependent on what the firm needs.

Indeed. It is simple to convert a Limited Liability Partnership into a Private Limited Company. Visit this page on LLP registration to learn more.

Support

Speak Directly to our Expert Today

Get In Touch

Registration of Private Limited Companies in India

- Delhi Pvt Ltd Company Registration

- Chennai Pvt Ltd Company Registration

- Kerala Pvt Ltd Company Registration

- Mumbai Pvt Ltd Company Registration

- Kolkata Pvt Ltd Company Registration

- Coimbatore Pvt Ltd Company Registration

- Bangalore Pvt Ltd Company Registration

- Hyderabad Pvt Ltd Company Registration

- Uttar Pradesh Pvt Ltd Company Registration

Additional Company Registration with Taxcult

- Registration of PVT LTD Company

- Registration of Partnership Firms

- Registration of Public Limited Companies

- Registration of a single person company

- Registration of a Company under Section 8

- Registration of Producer Companies

- Registration of Sole Proprietorship

- Nidhi Company Enrollment

- Registration of NGO